Student Loan Nightmares – a Hellish Prison Without Walls

Student loans, once hailed as a gateway to higher education and a promising future, have transformed into a financial burden for many. Student loan nightmares emerge as tuition costs soar and economic uncertainty looms, insurmountable student loan debt has become a harsh reality for millions of people, more and more realizing they will never be able to pay off student loans. . This essay delves into the multifaceted issues surrounding student loans, exploring the nightmares they can create for borrowers.

The Rising Tide of Student Debt is Actually a Tsunami

In recent decades, the cost of higher education has skyrocketed, outpacing inflation and wage growth. Consequently, students and families have increasingly turned to loans to bridge the gap between tuition fees and available funds. Federal student loans, private loans, and even parent loans have become commonplace, contributing to the ballooning student debt crisis. According to the Federal Reserve, outstanding student loan debt surpassed $1.7 trillion in 2021, burdening millions of borrowers with financial obligations that can last for decades.

The Crushing Weight of Student Loan Debt

For many borrowers, the burden of student debt is not merely a financial inconvenience but a psychological and emotional weight that looms large over their lives. The prospect of repaying loans can lead to anxiety, stress, and even depression, affecting mental well-being and overall quality of life. Additionally, the fear of default and its repercussions can be paralyzing, hindering individuals from pursuing opportunities such as home-ownership, entrepreneurship, or further education.

Navigating a Rigged, Complex System

Navigating the labyrinthine system of student loans can be a daunting task, especially for young adults thrust into the complexities of personal finance without adequate guidance. From deciphering loan terms and interest rates to understanding repayment options and forgiveness programs, borrowers often find themselves overwhelmed and ill-equipped to make informed decisions. Moreover, misinformation and predatory practices within the student loan industry further exacerbate the challenges faced by borrowers, leaving many vulnerable to exploitation and financial hardship.

The Trap of High Interest Rates

One of the most insidious aspects of student loans is the prevalence of high-interest rates, particularly with private loans. Unlike federal loans, which offer fixed interest rates and borrower protections, private loans often come with variable rates and fewer safeguards. As a result, borrowers may find themselves trapped in a cycle of debt, where the bulk of their payments go towards interest rather than principal, prolonging the repayment period and increasing the overall cost of the loan.

The Specter of Student Loan Default

Defaulting on student loans is a nightmare scenario for many borrowers, with consequences that can have far-reaching implications. From damaged credit scores and wage garnishment to legal action and social stigma, the repercussions of default can haunt individuals for years to come. Moreover, the current lack of bankruptcy protections for student loans further compounds the severity of default, leaving borrowers with few options for relief or recourse.

The Elusive Promise of Student Loan Forgiveness

While loan forgiveness programs exist for certain borrowers, such as those in public service or income-driven repayment plans, accessing these programs can be a Herculean task fraught with bureaucratic hurdles and administrative delays. The Public Service Loan Forgiveness (PSLF) program, for example, has been plagued by implementation issues and eligibility requirements that have left many borrowers disillusioned and disheartened. As a result, the promise of forgiveness often remains elusive for those who need it most, further perpetuating the cycle of debt and despair.

See Student Loan Nightmares for Yourself

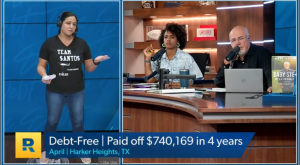

It’s one thing to read words on a page but nothing compares to listening to these horror stories best told by student loan victims themselves.

I’ve curated a few YouTube videos out of hundreds (thousands?) to really bring this point home…Just to make sure you’re crystal clear on the danger and destruction of student loans so you don’t ruin your life.

Search for “student loan nightmares” on YouTube. Here’s just a sampling of what you’ll find…

https://www.youtube.com/watch?v=PqzEcER8AJA

https://www.youtube.com/watch?v=ngWt2XiiVZg

https://www.youtube.com/watch?v=1pMmHa5cHvo

https://www.youtube.com/watch?v=KpZNyfSkyo4

https://www.youtube.com/watch?v=eOzb2gUgwOQ

https://www.youtube.com/watch?v=46sYQUboBXo

https://www.youtube.com/watch?v=xEj85vHVEEo

https://www.youtube.com/shorts/2_vzX9Q2q6o

https://www.youtube.com/watch?v=cSxaPcRmL9I

https://www.youtube.com/watch?v=GKJ8fP6g9jg

https://www.youtube.com/watch?v=S2LciuAd6Lw

https://www.youtube.com/watch?v=S2LciuAd6Lw

https://www.youtube.com/watch?v=alS0XVda8rM

https://www.youtube.com/watch?v=wvQR93C6n2E

https://www.youtube.com/watch?v=kCQiywN7pH4

https://www.youtube.com/watch?v=tk_Iie0ZyAk

https://www.youtube.com/watch?v=IQZ-qypi7ew

https://www.youtube.com/watch?v=w3oKCvfUImg

https://www.youtube.com/watch?v=aWJ0OaojfiA

https://www.youtube.com/watch?v=aWJ0OaojfiA

https://www.youtube.com/watch?v=BdN0pfubYa0

https://www.youtube.com/watch?v=r7JcHz6ucyI

https://www.youtube.com/watch?v=MhlbgEnSK6Q

These last two are very different and blow the lid off the whole scheme…

https://www.youtube.com/watch?v=nlM8Ak2KuYI

https://www.youtube.com/watch?v=kZJCrxQrslA

This is just a few of them… there are so many others.

I know you are very busy and I respect your time. That’s why I curated all of these videos for you – to save you lots of time and gathering the most relevant content for you.

Please respect my time too – the time I put in to compile this list by watching all of the videos for you in choosing the most pertinent ones. If you’re in a time crunch watch just 2-3 clips per day.

These poor people stepped up and put aside their pride to warn the world of what was inflicted upon them by student loans. I salute them for their humility and brutal honesty in shaming themselves so that people like you don’t become victims.

From people your age to middle aged folks to retired people there are so many sad stories. People losing their homes, having to work in their 60s and 70s to make their loan payments… People that can never retire.

…young adults who must pay their student loans for a degree they never ended up using…broken lives and broken families…

Some of them admit they will die with student loan debt. Every single story is tragic. And every single one of them is a victim.

You need to listen to all of them

Isn’t it fascinating there is not ONE book or article or video from somebody – ANYBODY – who was glad they took out a student loan?? That fact alone is terrifying.

PLEASE DRILL THIS INTO YOUR HEAD – There are no fairy tales or happy endings with a student loan!! Nothing good can ever come of this travesty!! There is no version of this sad story where you can win. Just sadness and loss. Student loan nightmares are real.

I said it before and I’ll say it again – choose anything you like for your next step in your journey through life with my blessing and full support.

ANYTHING EXCEPT STUDENT LOAN DEBT! Don’t make yourself yet another student loan victim. Don’t live your life in the hell of student loan nightmares.

Conclusion

In conclusion, student loan nightmares are a harsh reality for millions of borrowers across the country, reflecting the systemic failures and inequalities inherent in our higher education and financial systems. From the crushing weight of debt to the complexities of repayment and forgiveness, navigating the maze of student loans can be a daunting and often demoralizing experience. As we confront the challenges posed by the student debt crisis, it is imperative that we advocate for meaningful reform and solutions that prioritize the well-being of borrowers and ensure access to affordable education for all. Only then can we begin to alleviate the nightmares of student loans and pave the way for a brighter and more equitable future.