Financial coach services can help you reach your financial goals by guiding you in money management skills, such as how to create a budget, eliminate debt, establish an emergency fund, build wealth and protect your ever-growing assets. This journey from broke to breaking the bank usually occurs in the order listed in the previous sentence.

CNN Business: What is a financial coach and who really needs one?

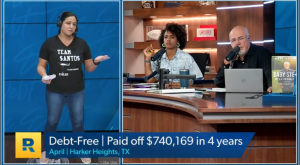

A financial coach helps you create goals and actually stick with them so you’re not just dreaming about financial peace—you’re living it. Financial coaching is different from any other finance-related job. CPAs help you with your taxes. Financial advisors help you with investments. But financial coaches work with you to create a start-to-finish plan for your money and help keep you on track.

Financial coaches often work with their clients over several sessions—focusing on anything from fine-tuning your budget to discovering your long-term goals to working through a real financial crisis. No matter the situation, financial coaches sit with you one on one (we call it “kneecap to kneecap”) to help you overcome the challenges that hold you back in your finances.

Your Las Vegas financial coach will assist you with the behavioral and emotional components of managing money. A coach can help you unearth what drives your financial decisions, so you can create a healthier attitude that leads to better money habits.

Financial coaches typically meet with their clients on an ongoing basis to work towards a specific set of financial goals. These goals fall into two general categories; escaping the living hell of being perpetually broke leading to building wealth and living the good life OR if you’re already living comfortably, your Las Vegas financial coach will help you up your game. Financial coach services cover a wide array of money topics and life events.

The Basics of Money Coaching:

- Understand your spending habits

- How to create a budget

- Debt elimination

- Build credit / repair credit / boost your FICO score

- Establish an emergency fund

- Pre-marital money counseling

Advanced Cash Coaching:

- Starting a Business, business optimization and/or turnaround

- Buying a new home

- College planning

- Divorce preparation/damage control/post-divorce recovery and rebound

- Building wealth through liquid assets – including retirement planning

- Intelligent choices in insurance coverage

- Bullet-proof and lawyer-proof asset protection

- Passing your family fortune on to future generations

Between these two polarities are dozens of gray areas where financial coach services can guide you. Some examples include bankruptcy decisions, prepaid burial expenses, prepaid college tuition, student loan considerations, rent versus buy calculations, family planning from a financial standpoint, reverse mortgages, lifestyle design and so much more. Bet you never thought financial services could be so expansive!

Make an appointment.